Wave Accounting Software Reviews, Demo & Pricing 2023

To help you make educated choices about cybersecurity to keep you (and your data) safe and secure, by providing honest, accurate, and practical information based on thorough testing. Once this is done, you will gain access to the platform and can start invoicing. Wave offers integration with Google Sheets, BlueCamroo, and Zapier. This can increase the functionality of the solution and increase efficiency. Pricing is an important decision factor for many small businesses. Wave acknowledges this fact in the design of its pricing system.

Account creation is restricted to business owners from the US and Canada. If your business is not in one of these two countries, then you can not create an account with Wave or use any of their solutions. Wave offers multiple ways to reach customer support, and their accessibility will depend on whether you are a fee or paying user.

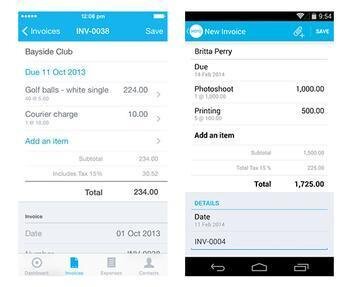

With Wave, you can connect your bank account and credit cards, track expenses, and run reports. Once logged in, your main dashboard will show your cash flow, profit and loss, invoices, bills and other financial insights. From the dashboard (or the Banking menu on the left-hand side), you’ll be able to connect your bank and credit card accounts to automatically download and categorize your transactions.

How to Download and Install Wave on Your PC for Free

Moon Invoice is one of the frontrunners in providing a seamless, all-in-one invoicing solution. This online accounting software has delivered robust invoicing solutions to its clientele since the invoicing era. It serves as a free online invoice maker and works equally well for small business owners and large enterprises and perfectly suits their niche requirements.

- We’ll automatically create tasks for you (like when it’s time to invoice your client).

- The Cash Flow report appears at the top of the screen in graph form, followed by Profit & Loss.

- It proves as one of the best free accounting software for business.

- This can increase the functionality of the solution and increase efficiency.

- While Wave provides unlimited invoices, it might be best to look elsewhere if you are looking for more robust account software.

While Wave has a lot to offer when it comes to invoicing, know that it’s still slightly less automated than some competitors. This isn’t necessarily Profit and Loss Aptitude Questions and Answers a deal-breaker, but it might require a bit more bookkeeping work. For information on credit card rates, visit Pricing for details.

Sign up for Lab Report to get the latest reviews and top product advice delivered right to your inbox. Its onsite guidance includes an excellent interactive support bot that lets you ask questions and helps you narrow down your queries. As we definitely know, being an entrepreneur implies managing invoices consistently to monitor the enterprises you deal with and the installments you get. I have been using @andco by @fiverr for a few months now but in the last three weeks as hourly work picked up, have been using it more. I enjoy it so much I might just keep using it when hourly dips down. I really dig what you’re doing and how not crazy I have become using it.

Wave accounting pros and cons

To the right of each is a checkmark, which you click to verify that you have reviewed the transaction. So, this was a list of the 20 Wave accounting alternatives for small businesses. With proper research and a deep dive into their invoicing world, you can get the best Wave alternative you’ve always looked for to start your business without any invoicing blues. Try these best accounting and invoicing apps with the free trial & later move ahead with a premium plan as per your business requirement. The online cloud accounting software is an incredible resource that makes your everyday errands more straightforward, ensures precision, oversees participation, and rapidly gets installments online.

The third tab is for Activity, where you see a list of your interactions with the customer. It is one of the best alternatives to Wave accounting software in 2021. With Wave accounting, you can easily connect to the invoicing platform, which has advanced features like recurring billing and automatic payments.

Wave Accounting Review 2023: Pros, Cons, Alternatives

A common issue when invoicing in Microsoft Word, Excel, or other DIY solutions is making calculation errors. Wave’s invoicing software for small businesses removes the worry of making these errors because calculations are done for you, including the taxes. We provide different levels of support for customers who use different features and services from Wave. All your invoicing and payment information automatically syncs with the free Wave Accounting software included with your account. It’s a fairly slim set of reports for a double-entry accounting website, but it provides adequate coverage considering the site’s feature set.

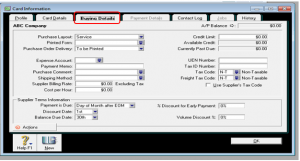

But do you know you can still use any of your favorite Android or iOS apps on your laptop even if the official version for PC platform not available? Yes, they do exits a few simple tricks you can use to install Android apps on Windows machine and use them as you use on Android smartphones. Record templates for customers and vendors only contain fields for basic details about each in Wave.

- The facilities are monitored 24/7 and access to your information is strictly controlled.

- Manage your to-do list within Fiverr Workspace to keep track of what needs to be done.

- The fact that it is free makes it a great option for those just starting out or those who want to keep their overhead as low as possible.

You get receipts for every transaction you do, giving you an accurate picture of your expenses and income and helping you identify gaps that need to be addressed. Though Wave may provide the essentials to meet your business’ invoicing needs, you still might want to consider some factors before deciding to commit with this invoicing tool. Zapier moves info between your web apps automatically, so you can focus on your most important work. Zapier lets you connect Wave with thousands of the most popular apps, so you can automate your work and have more time for what matters most—no code required.

How to set payment reminders?

The most basic plan, Simple Start, costs $30 per month, and the top-tier Advanced plan costs $200 per month, which is a sizable investment if you’re running a business on a tight budget. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the app marketplace. There are also add-on Intuit services like QuickBooks Payroll or QuickBooks Time.

However, we do suggest checking out Wave accounting alternatives, as they may provide the same features but for a slightly more affordable price. In addition, other accounting software may be more suitable for larger businesses and those looking to grow. What many point out is that it is easy to automate bookkeeping and billing with Wave, as the software automatically syncs accounting and invoicing. In addition, users are very pleased with the fact that invoicing features are unlimited and customizable. Wave payment processing feature allows users to accept credit card and ACH payments. Wave users can accept all types of payments including via bank deposit, credit card, and Apple Pay.

This can potentially be a dealbreaker for a product-based business. The user will encounter fees by using additional services, which will now be described. Wave Invoices is an all-in-one money management solution headquartered in Toronto, Ontario, Canada. Wave caters to the needs of small business owners such as freelancers, self-employed entrepreneurs, consultants, and contractors. As noted up and down this article, Wave has become one of the most popular accounting software platforms for small businesses and freelancers out there.

Wave manages to include what you need to know about transactions on one screen. Most of it is taken up by a current list of the income and expenses you’ve imported from financial institutions or added manually in table format. The table’s columns show each transaction’s date, description, account, category (which you can edit if it’s wrong or blank, which happened frequently to me), and amount.